Finance, Then and Now

§

by Elizabeth Ahrens-Kley

The recent economic rescue plans undertaken by the U.S. government to stave off fiscal calamity, including a $787 billion stimulus in September '08, followed less than two years later by an eye-popping $955 billion from the Europeans and IMF to prop up indebted Euro nations, makes one believe that governments around the world are not hesitating in treating tax dollars as gambling chips, seemingly without much monetary value. Losing the poker game simply means the chips are lost! Winning simply means buying time to allow debt-plagued countries to recover enough to build some fiscal and monetary credibility. George Washington, whose image by American portrait artist Gilbert Stuart is on the one dollar bill, surely would be turning as green as the color of the bill at these vast and fearsome sums. Lest history be not forgotton, a brief glimpse back at the state of banking in Philadelphia, the bustling port and capital city of America at the turn of the 19th century, will shed light into the vast gulf existing between the banking institutions of then, and now. In particular, the story of Samuel Meeker’s “overborrowing” is of interest.

Complex collateralized debt obligations did not exist, nor did savings banks, or trust and loan companies. Nor commercial banks. The Fed was not established until 1913.

In the 1780s the first American banks were small state banks (at this time there were three: Philadelphia, New York, and Boston), and there was no central banking system. With the adoption of the new constitution, the financial system was substantially reformed beginning 1788, culminating in the establishment of the First Bank of the United States in 1791 endowed with the role of aiding federal finanacial operations and leading the way to development of a US banking system. The bank was capitalized at a then whopping $10 million, the state banks at that time were only capitalized at $1 million or less. Only the First Bank of the United States was nationwide and while servicing the large government debt, the smaller state banks commonly lent capital for local and regional business, trade, and infrastructure—from the three existing state banks in 1790, the number grew to 28 by 1800, all in New England and the Middle Atlantic states.

1803 was a year in which not only Philadelphia experienced an accelerating prosperity, it was also a momentous year in the life of Samuel Meeker (1763-1831), scion of a well-known prominent family from New Jersey. Transplanted to Philadelphia in the early 1790s in search of opportunity, he was one of a group of lesser known but ambitious young men willing to challenge the restrictive lending practices of the small group of old established families which controlled the field of finance at this time in the capital. The general complaint was that money was chiefly locked into the hands of these relatively few conservative individuals, who were mainly beholden to investors in England, who lent too little locally and most often to only a favored few, substantially restricting growth of commerce; and private lenders charged much too exorbitant rates of interest. Meeker was one of these progressive-minded citizens, this group of enthusiastic amateurs inexperienced in the profession of banking, but willing to make their own gamble that the time was ripe to exploit economic potential; by establishing a new line of credit, at reasonable rates of interest, to supplement the three other banks then dominating the commercial activity of the city. These individuals, leaders responding with creative energy to the current business climate in Philadelphia (still the country’s largest and busiest port) gathered together to draw up a plan for a new Bank.

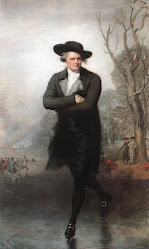

Handsome, energetic and athletic (upstanding member of the Gloucester Fox-Hunting Club!) & understanding that new avenues of capital would help lubricate the wheels of commerce and prosperity in the capital, while also benefitting his own trading business Meeker, Denman & Co., Meeker was one of sixteen directors elected to the board of the new “Philadelphia National Bank” in the summer of 1803. A subscription book was opened for the sale of stock, the total amount of the Bank’s stock was subscribed and was placed at one million dollars. Organization of the bank proceeded rapidly, the board (including Meeker) met daily, the collected money was deposited in a box at the Bank of Pennsylvania. “A proper set of books, stationery, scales, weights, shovels and other materials” were ordered and steps were taken toward the drafting of rules and regulations. A few months later in the fall, Meeker’s own business received the first loan from the Philadelphia National Bank. Not only did Meeker receive the first loan from the new bank in 1803, he and his twin sister Phebe turned 40, both these circumstances surely providing the inspiration for what transpired next. Signalling acheivement at joining the ranks of the top social and financial elite, Meeker commissioned his portrait to be done by the premier portrait artist of the day, Gilbert Stuart, to be given as a gift to his beloved sister. Since the twins’ birthday was in the summer, surely a lavish and extravagent party was thrown to celebrate the event at Meeker’s well-known country estate on the banks of the Schuylkill River, Fountain Green. Here at this two-story stone house with commodious wings built to each side the guests would arrive by horse, dine on steak butchered from cows fed in the stalls on the property, and treated to the finest fruits and vegetables grown in the highly cultivated gardens. What a fabulous excuse to leave the hot and humid city in the summer (and to escape the periodic fevers), to mingle with many of the finest citizens of the city, and view the unveiling of a new Stuart portrait!

Epilogue: it is ironic to note that only by special vote of the board could a loan by the Philadelphia National Bank be made of more than thirty thousand dollars, and that this vote was only accorded to the directors. Meeker apparently found it impossible to limit his own loans from the bank on numerous occasions, leading to his exclusion from the board in 1807. Possibly Meeker’s financial dealings were too much like gambling.

§

(© All rights reserved.)

§